Limit Orders

What is it and How to place it

A limit order is an instruction to buy or sell an asset at a specific price or a better one.

Limit orders are often used by investors who want to control the price they pay for a security. They can also be used to set a maximum loss or to protect profits.

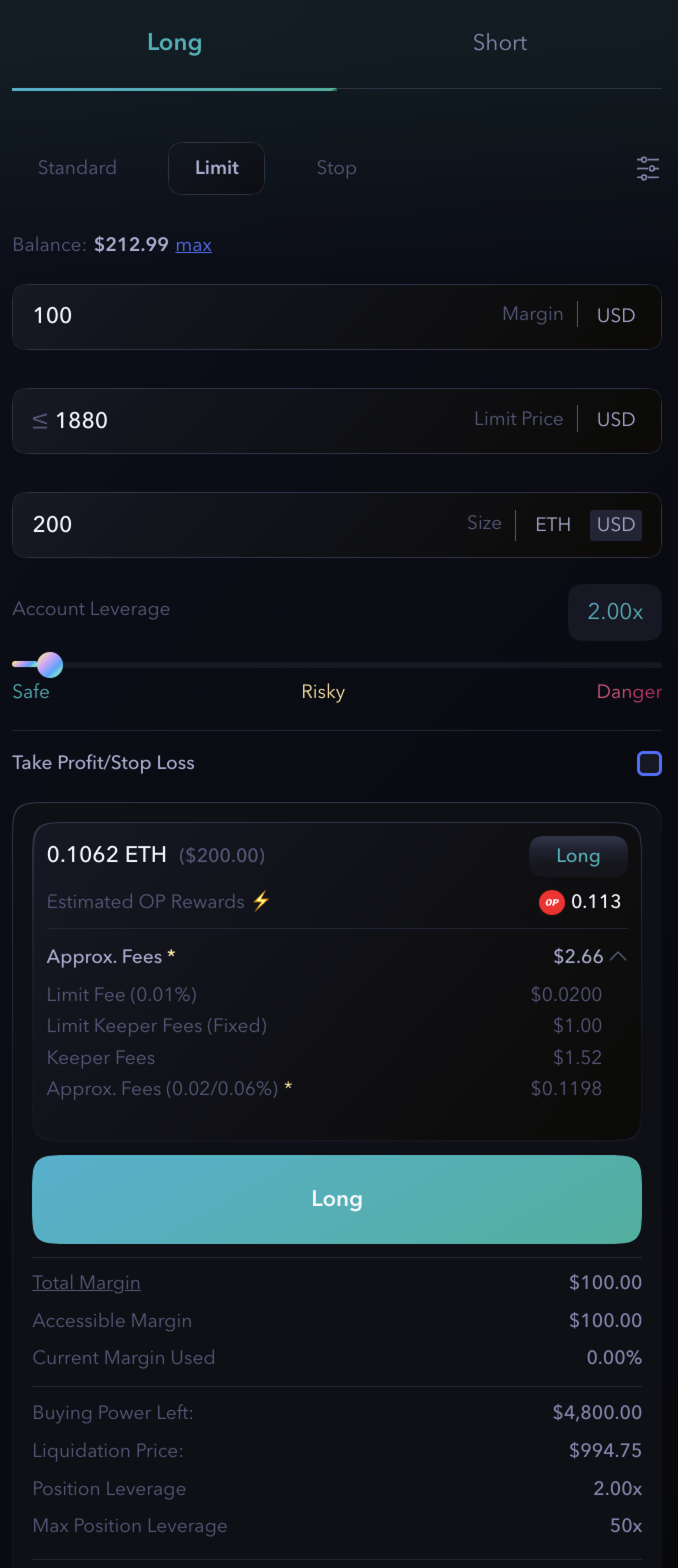

Create a Limit order

To place a Limit Order:

Select the asset to trade;

Select

LongorShortto decide the side of the trade;Choose the

Limitorder type;Enter an Collateral Amount, if needed;

Input the Limit Price - set the max or min price at which you are willing to long or short;

Enter the position Size and Leverage;

Click on

LongorShortto confirm.

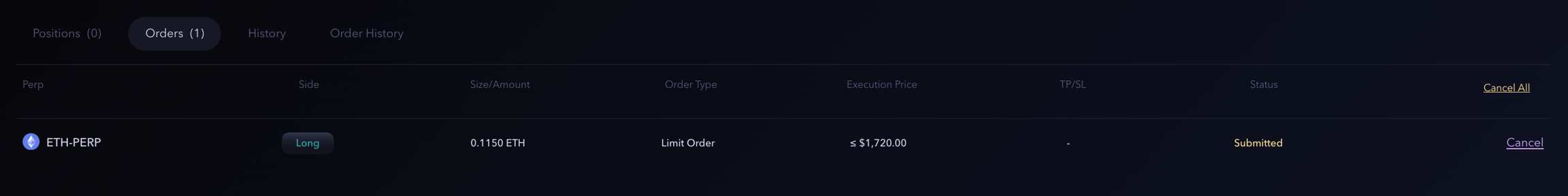

Once the new limit order is created, it will appear under the Orders tab. Users can cancel the limit order at any point in time.

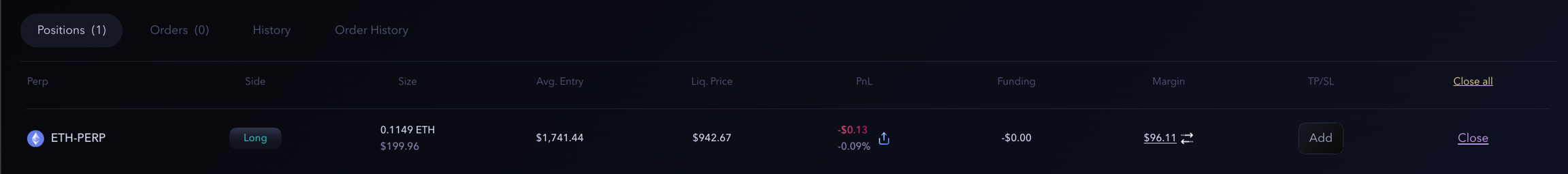

When the price execution reaches the limit price, the order will be executed, and your position will be opened.

In the case of a high price divergence (more than 2%) between Pyth and Chainlink, the execution price will be based on the Chainlink price.

After a conditional order is triggered, there is no guarantee of its successful execution. Factors such as liquidity constraints or network congestion can significantly affect the order's completion. With the Pyth prices the rate of successful execution increased.