Stop Orders

What is it and How to place it

A stop (long) order is used to capitalize on an upward price movement or to enter a trade at a specific level. It is commonly used by traders who wish to buy an asset once its price surpasses a predetermined stop price. When the market price reaches or exceeds the stop price, the stop order is triggered, and the buy order is executed, allowing the trader to enter the market or capture potential gains. In a similar way, when a downward is expected is possible to place a stop (short) order in key prices and around resistances.

Create a Stop order

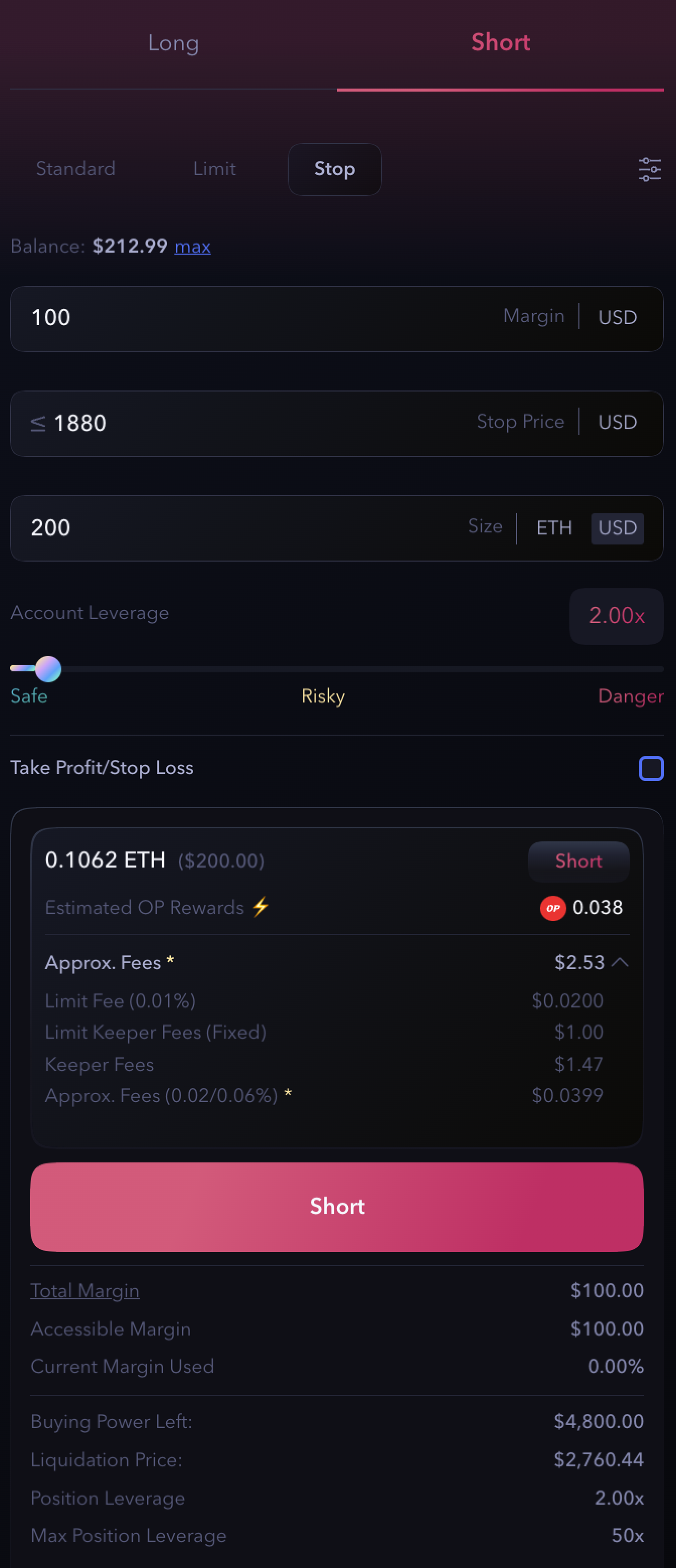

To place a Stop Order:

Select the asset to trade;

Select

LongorShortto decide the side of the trade;Choose the

Stoporder type;Enter an Collateral Amount, if needed;

Input the Stop Price - set the max or min price at which you are willing to long or short;

Enter the position Size and Leverage;

Click on

LongorShortto confirm.

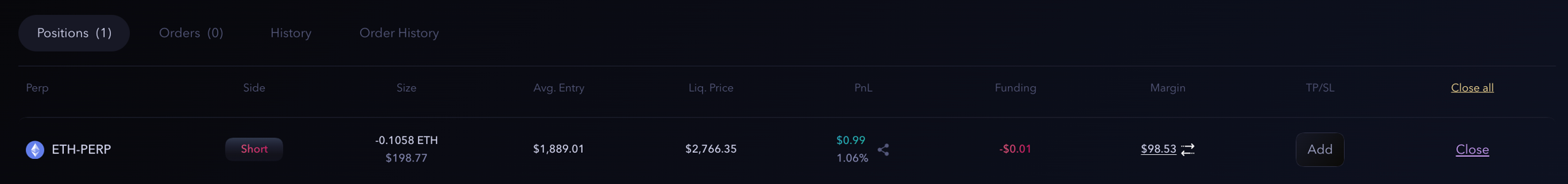

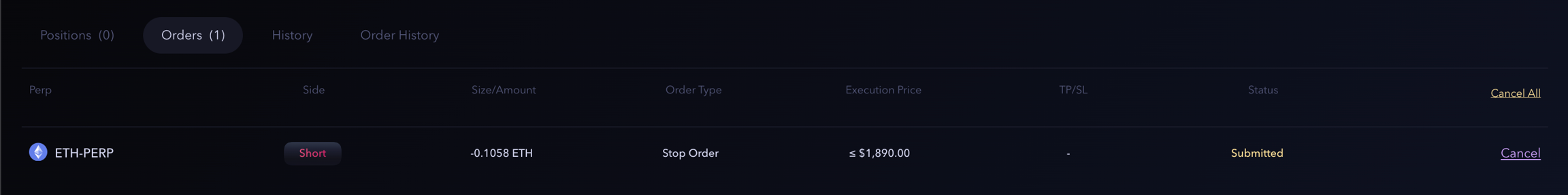

Once the transaction is executed, the order will appear under the Orders tab. Users can cancel the stop order at any point in time.

When the price reaches the stop price, the order will be executed, and your position will be opened.