Basics of perp

Perpetual futures are similar to traditional futures contracts, but they do not have a fixed expiration date and instead use a funding mechanism to keep the contract price aligned with the underlying spot price.

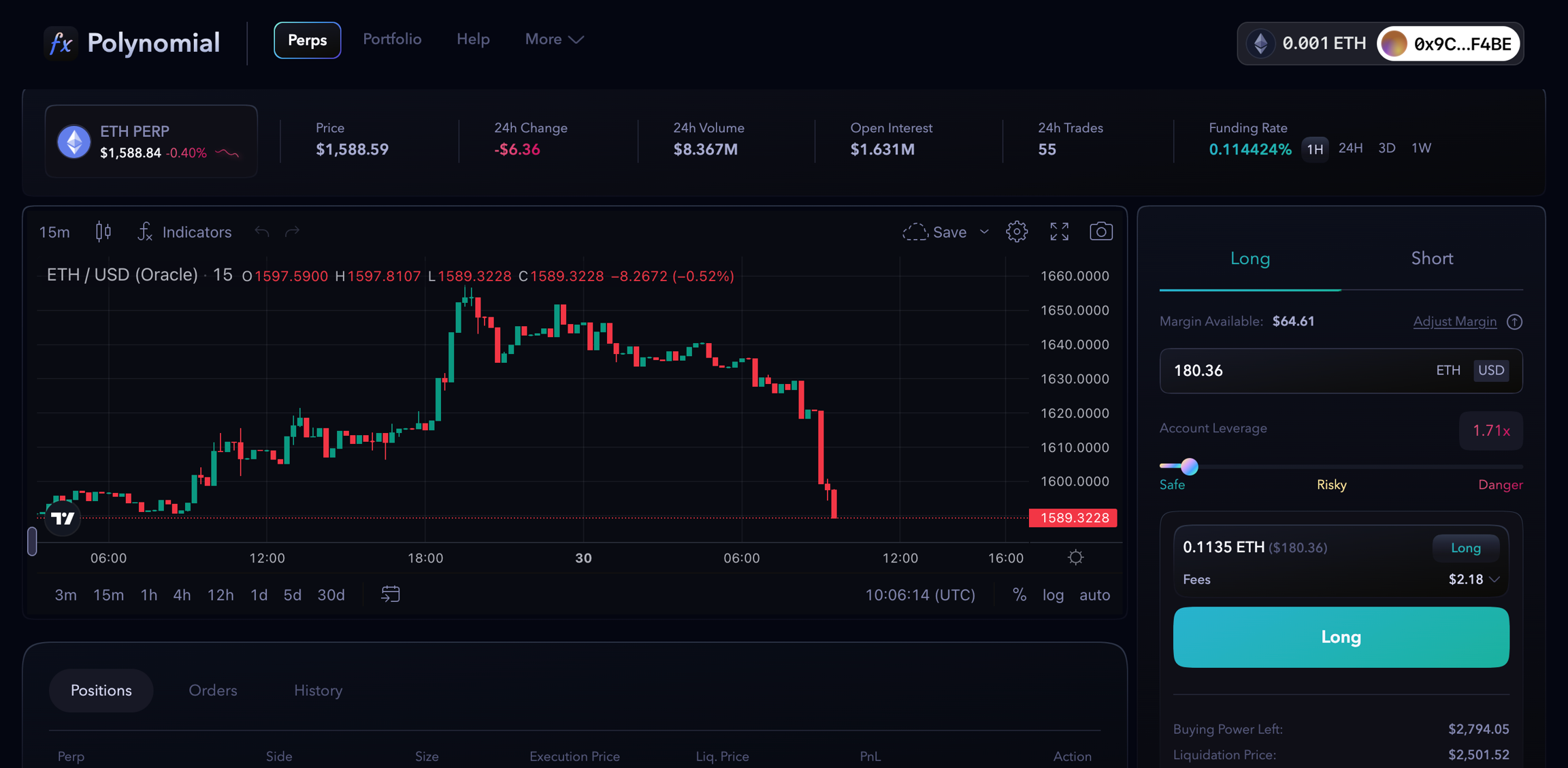

Long Position

A long position in a perpetual futures contract is a position that a trader takes, expecting the price of the underlying asset to rise. This means that the trader is buying the contract with the expectation that they will be able to sell it at a higher price in the future, resulting in a profit.

In a long position, the trader is said to be "long the contract" and is essentially betting on increasing the underlying asset's price. If the price does indeed rise, the trader can close out their position by selling the contract at a higher price than they bought it for, resulting in a profit. If the price falls instead, the trader will incur a loss.

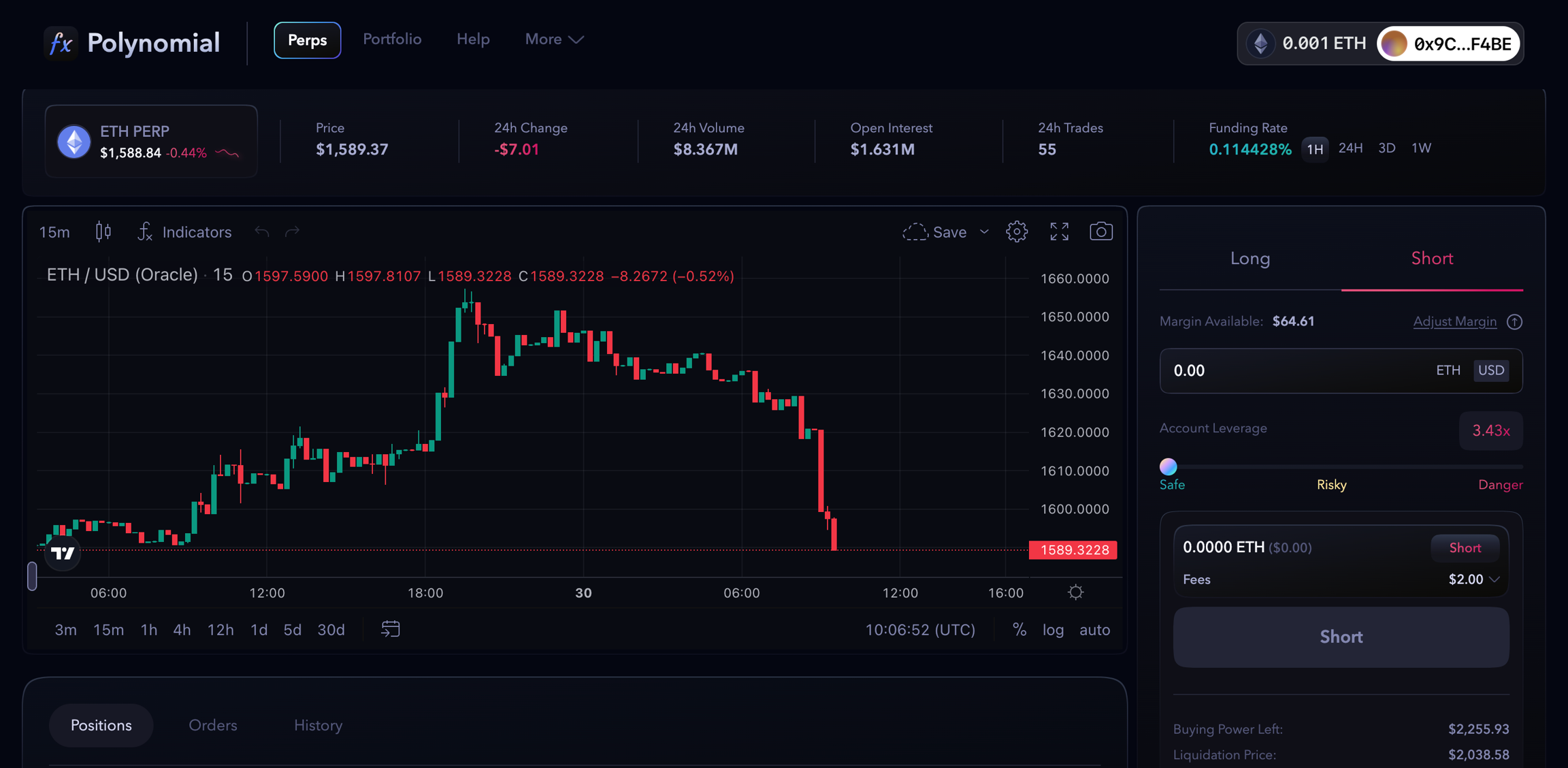

Short Position

A short position in a perpetual futures contract is a position that a trader takes expecting the underlying asset's price to fall. This means that the trader is selling the contract with the expectation that they will be able to buy it back at a lower price in the future, resulting in a profit.

In a short position, the trader is said to be "short the contract" and is essentially betting on decreasing the underlying asset's price. If the price does indeed fall, the trader can close out their position by buying the contract back at a lower price than they sold it for, resulting in a profit. If the price rises instead, the trader will incur a loss.