Leverage

High leverage always kills the position. always trade safely and position yourself to avoid Liquidation.

Leverage in perpetual futures refers to the use of borrowed capital to increase the potential return on investment. In the context of perpetual futures contracts, leverage allows traders to enter into larger positions than they would be able to with the same amount of capital.

For example, if a trader has $1,000 of capital and the perpetual futures contract they are trading has a leverage ratio of 10:1, they will be able to enter a position worth $10,000. This allows the trader to amplify their potential returns, as a 10% move in the price of the underlying asset would result in a 100% return on the trade.

Leverage can be beneficial for traders who expect the price of the underlying asset to move significantly, as it allows them to amplify their potential returns. However, leverage can also increase risk, as it amplifies potential losses as well. If the price of the underlying asset moves in the opposite direction from what the trader expects, their losses will be magnified by the amount of leverage they are using.

For this reason, it is important for traders to use leverage carefully and manage their risk effectively. This may involve setting stop-loss orders to limit potential losses or using risk management tools like position sizing to ensure that their exposure to risk is within their tolerance levels.

Max leverage on the exchange is limited to 50x

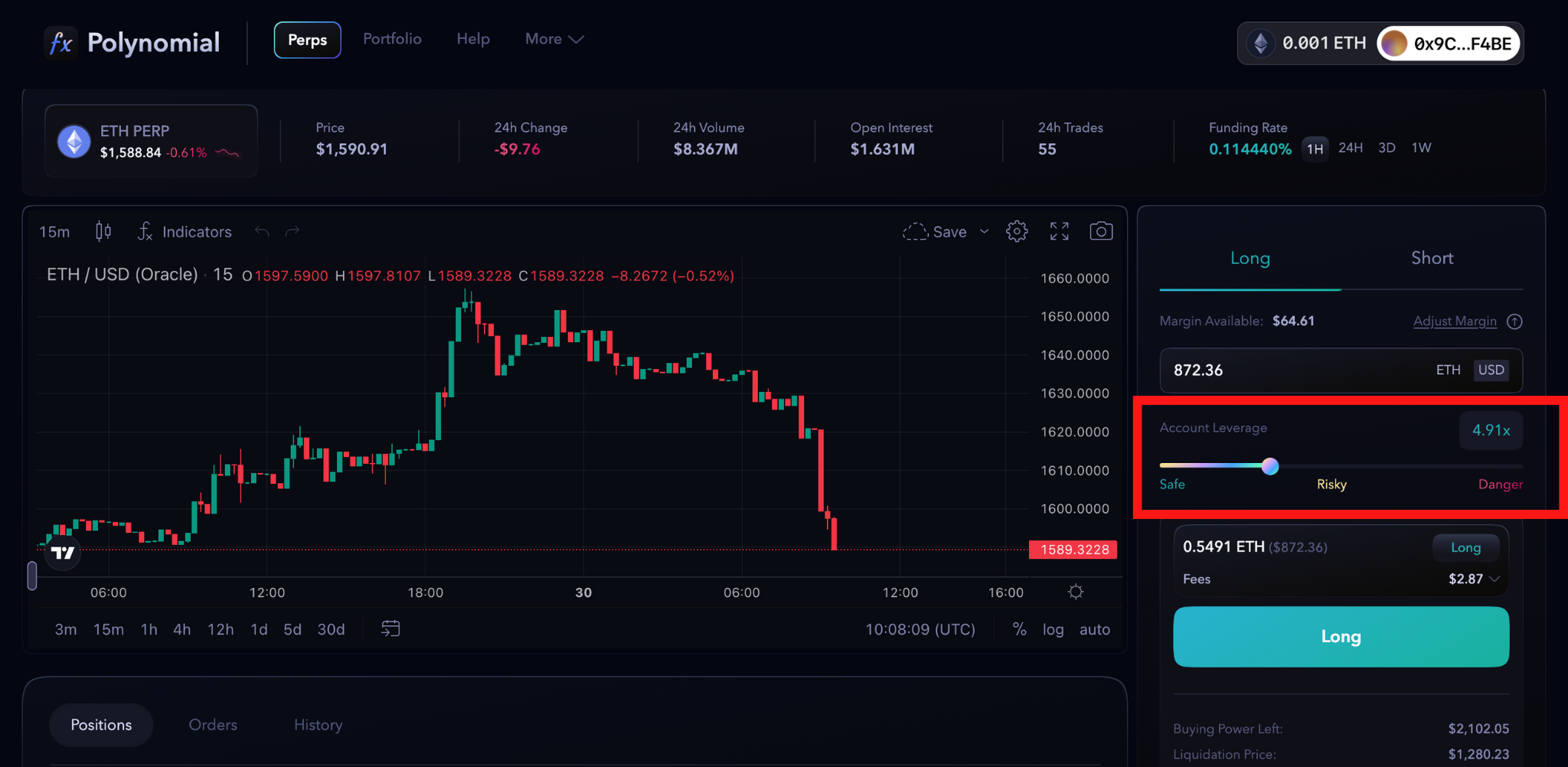

Users can use the slider bar to set the leverage