FAQ

Frequently Asked Questions

Who provides liquidity for trades on Polynomial?

Polynomial Trade is built on top of the Synthetix protocol, and trades on the platform are executed with SNX stakers acting as counterparties. Synthetix stakers receive fees from the platform for providing liquidity.

I cannot see my funds in my smart wallet after closing a position. What should I do?

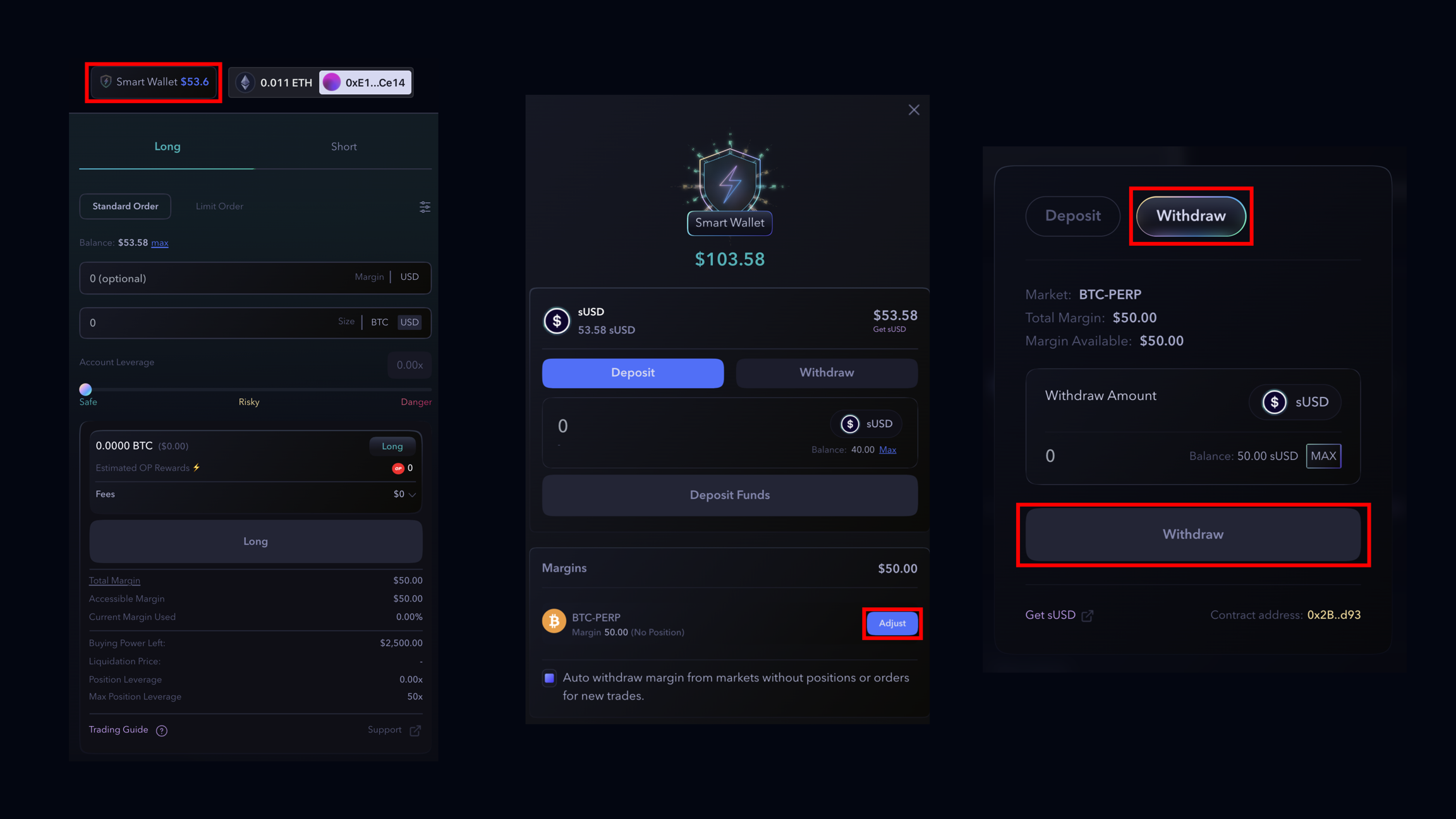

After closing a position, your funds will not appear in your smart wallet but will be added to the margin of the specific asset you traded. To withdraw the funds from the margin to your smart wallet, navigate to your Smart Wallet and click on Adjust for the market with margin. From there, you can choose to Withdraw your amount. You can also add the funds to different margins from your smart wallet or withdraw them to your MetaMask account.

Please note that if you withdraw margin, your limit order will not be executed.

Follow the instructions above to withdraw sUSD to your smart wallet.

Can't I open a position?

In order to open a trade, the user must have a minimum of $50 in margin. If the required amount is not available, users will need to add more sUSD to their margin to open a trade.

Why can't close my order?

You won't be able to close your trade if your margin is below $50. In order to meet the minimum margin requirement and close an active position, you'll need to add more margin. Keep in mind that there is a fee between $0 and $4 for the network (keeper bots), which will be deducted from your margin. If you don't have enough margin remaining, you'll need to add more funds in order to place any new trades.

Why my position expired?

Standard Order: When the price of an asset is highly volatile, it can be difficult for a keeper to fill an order at the ideal market price. In such situations, rather than filling the order at an unfavourable price, the order may expire.

Limit Order: To be filled, it must remain within the range of the "Trigger Price" and "Limit Price" for a brief period of time. If this range is not reached before the "Limit Order Expiry" period, the order will expire.

More details can be find here: Orders

Order expire, what should i do now?

As reported on Expired Order, after an order expires you can decide to:

Do nothing or cancel the order. Your order tab will be clean again.

Retrythe expired transaction, with a 1-click button to reproduce the transaction at market price.Create a new order, so the expired order gets cancelled in the same transaction.

Why didn't my limit order go through?

If the market moves too quickly and the limit price is not reached, the order may not be executed, and it will become an invalid order. In this case, the trader may need to adjust their trading strategy or intervene manually to manage their position.

I had accumulated funding, but now it shows $0

Whenever you carry out a transaction (such as depositing, withdrawing or making a new trade), the funding amount is added to your margin. If the accumulated funding rate is positive, your margin will increase, and if it is negative, your margin will decrease. After any of these operations, your funding will be reset to $0.

How many fee do I pay?

Standar Order:

2/6-10 bps, Maker/Taker fees based on the market skew;

Keeper Deposit, fee given to the keeper bots to execute the trade, based on the current gas price.

Limit Order:

2/6-10 bps, Maker/Taker fees based on the market skew;

Keeper Deposit, fee given to the keeper bots to execute the trade, based on the current gas price;

Limit Commit Deposit (0.03%);

Limit Keeper Deposit ($1.50).

More info about fees here.

My RPC is slow and doesn't work

It is available a complete guide on how to setup and update an RPC.

Liquidation & Keeper fees

When an account is close to being liquidated, it must be flagged. This flagging process requires gas. The cost for this gas is taken from the funds (margin) in your account.

It's advised to be cautious when trading with high leverage while using the maximum margin of your account. This is particularly important for smaller accounts (less than $250). Why? Because trading in this manner could lead to a liquidation price that is different from what is displayed in the User Interface (UI).

How Does a Gas Spike Affect Liquidation Price?

During periods of high network activity, gas prices can spike. If the flagging process for your account occurs during one of these spikes, the cost of gas will be higher than normal. This increased cost will consume more of your margin, which in turn can affect the liquidation price of your account.

Last updated