Trading Guide

Connect your wallet

Connect your web3 wallet to the exchange and make sure it's connected to the official Polynomial trade website:

Make sure you are connected to the Optimism mainnet, if not, check how to setup or update the RPC in the dedicated page: Setup RPC.

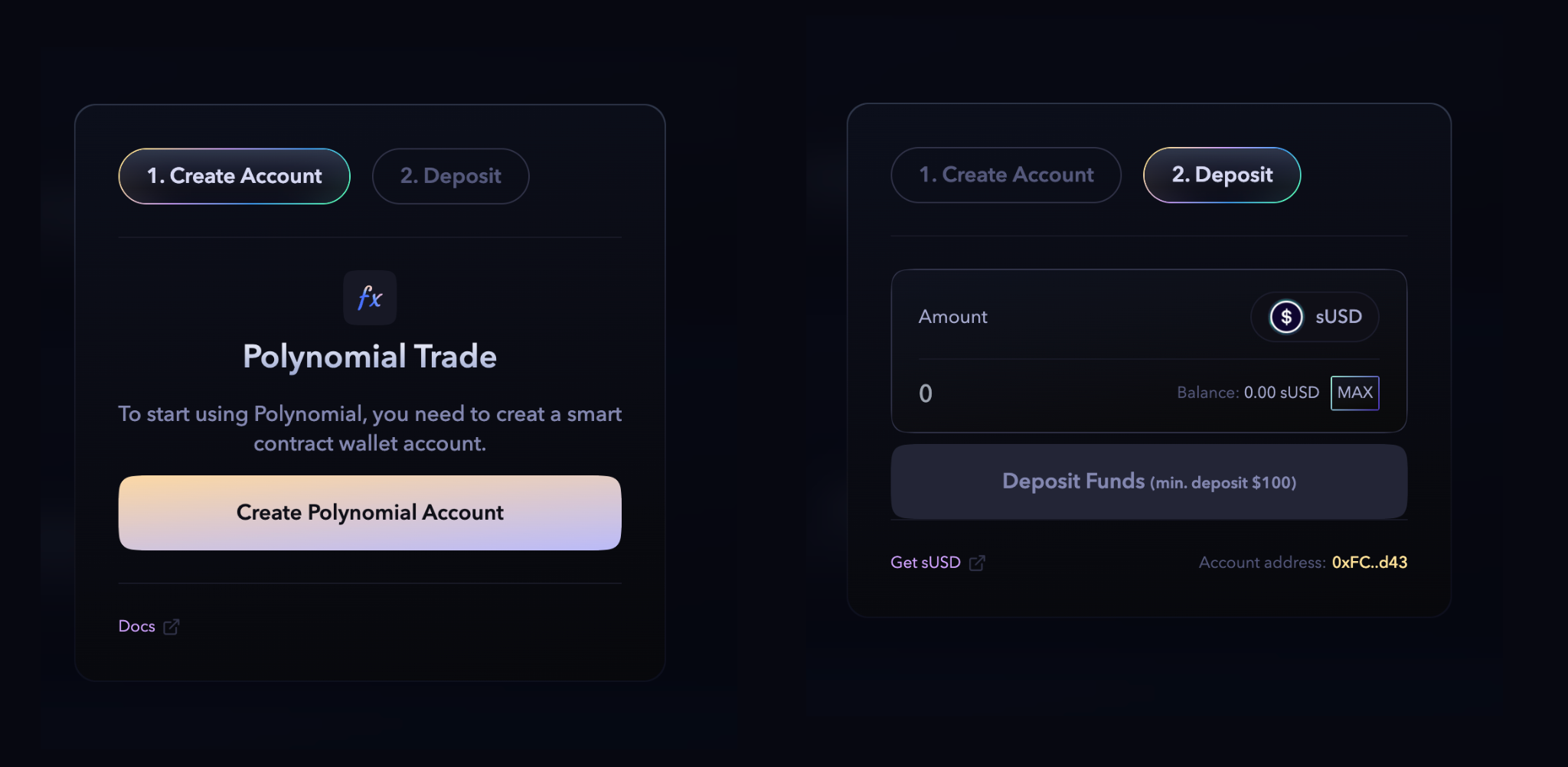

Create smart wallet and deposit into smart wallet

Polynomial trade uses smart contract wallets to access the exchange. Click on create an account and create a Polynomial smart account. Read more on: Smart Wallets.

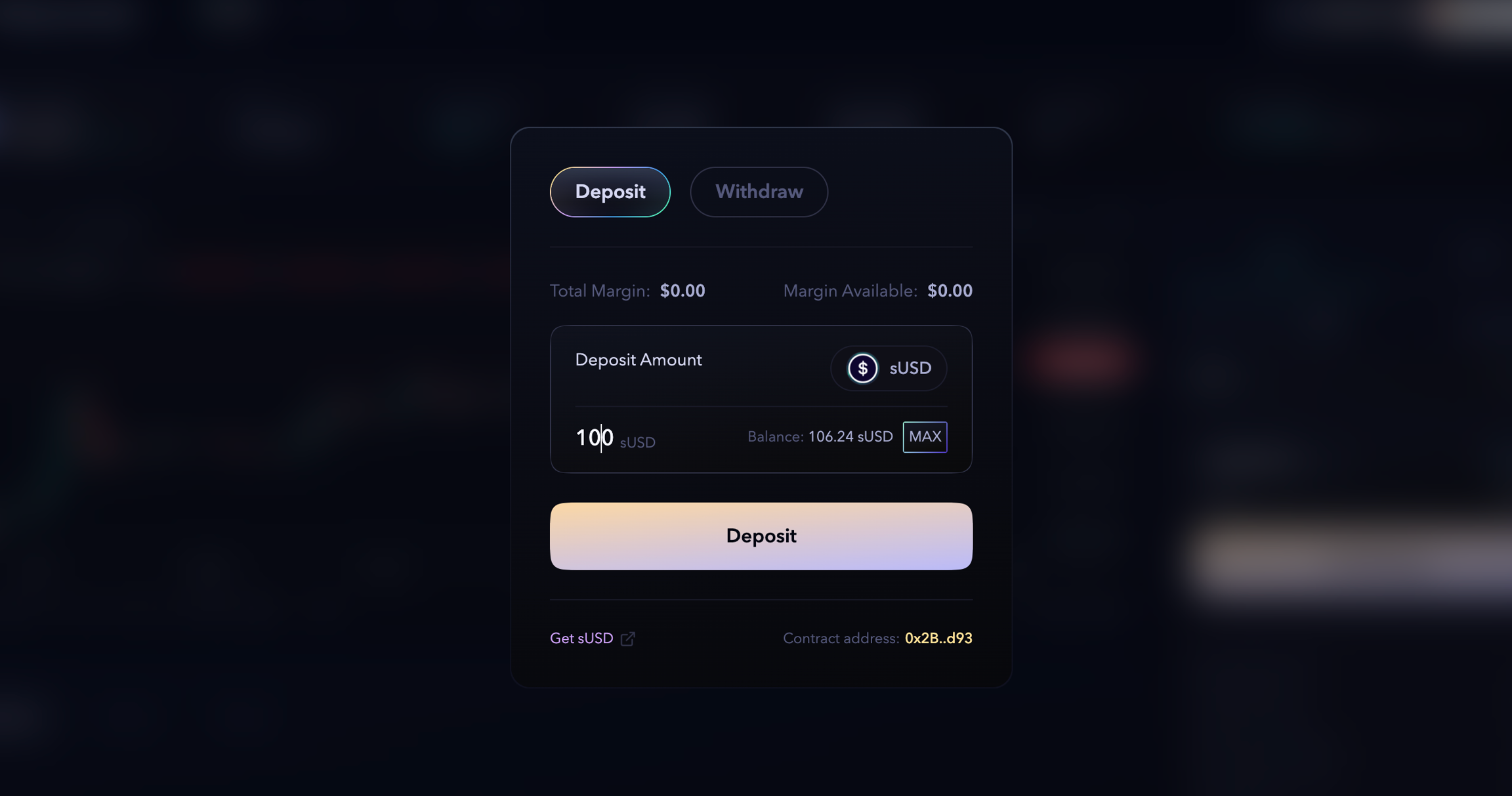

After creating the smart wallet, the trader needs to deposit sUSD to the smart wallet. Complete the transaction and the deposit will be added to the SC wallet.

Getting sUSD

Polynomial trade is built on top of Synthetix derivatives and uses sUSD as a deposit asset. Traders can get the sUSD swapping from different aggregator protocol. If you don't have funds in Optimism, then follow the steps,

Bridge your assets through your fav bridges to Optimism

The transfer of assets may take a few minutes and will be deposited onto your Optimism network upon completion.

After bridging your ETH to sUSD. Swap using protocols like: 1inch, Odos, DefiLlama Swap.

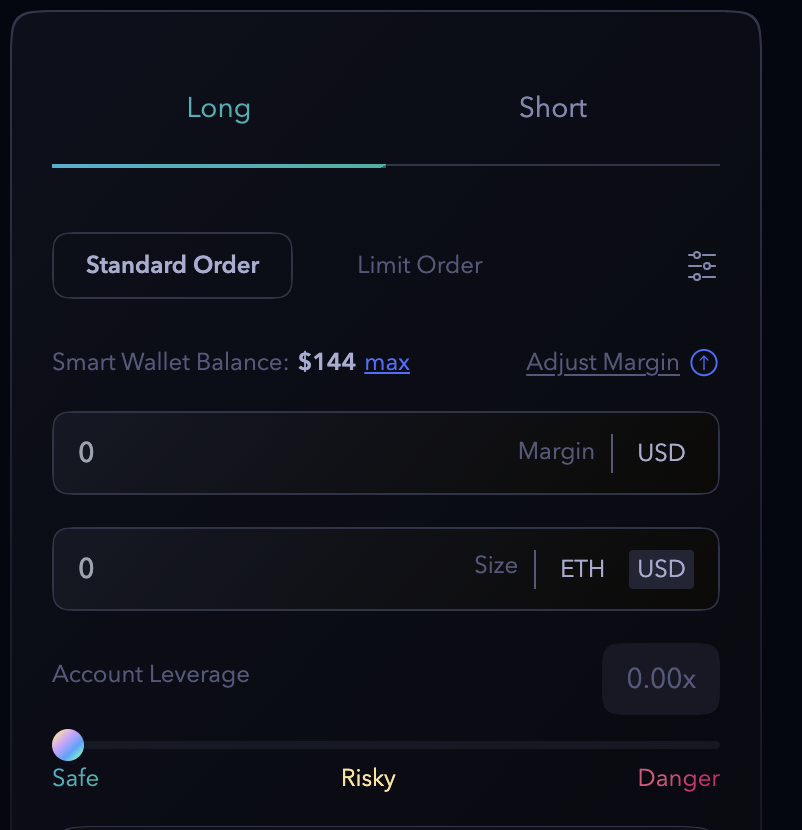

Add margin

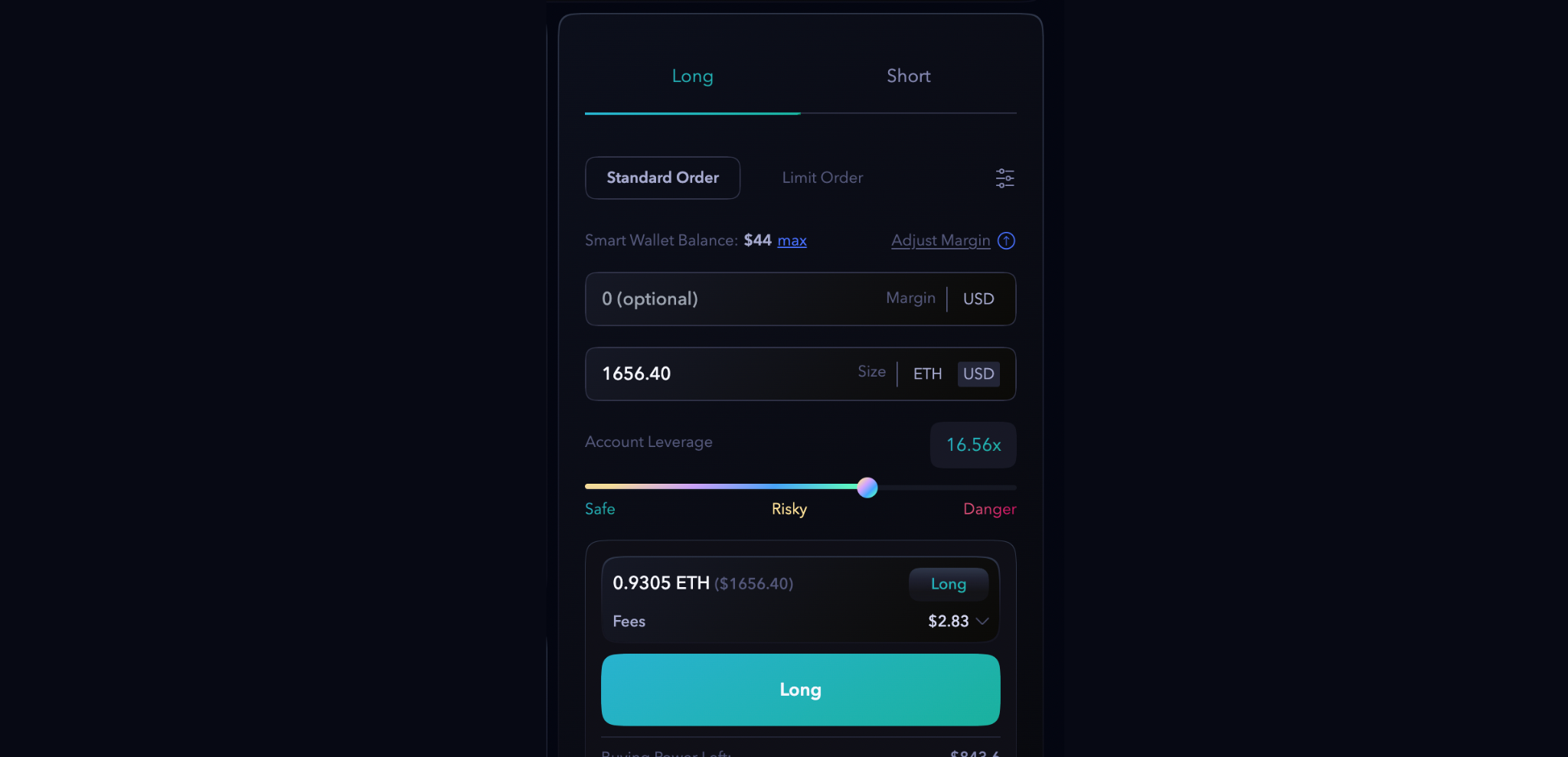

After adding funds to the smart wallet, traders can add margin to the respective markets. The minimum margin to start trading is $50, and no max limit exists.

Click on adjust the margin and add your sUSD to the margin to start trading. You can always add a margin later by clicking adjust margin.

Open a position

Video Tutorial

Place an order

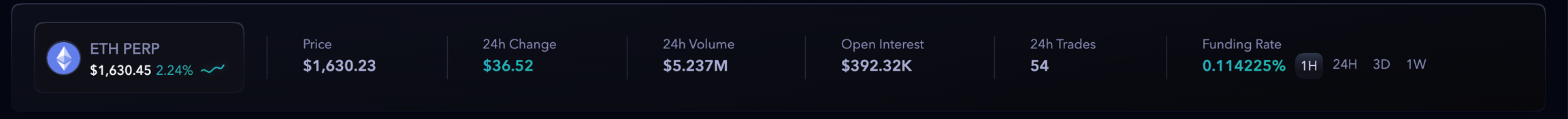

Use Long or Short according to your market view and open a position by entering the margin you want to use. Polynomial trade has different types of orders which are standard, limit, stop and TP/SL order. Select the convenient type order depending on your strategy.

If it is still unclear how Long and Short trades work, you can refer to the Basics section. Once the user has decided on the direction of their trade, they can enter the trading amount and choose the desired leverage. At this point, the fees and keeper deposit will be displayed, and the user can review the fees before opening the position. Clicking on either Long or Short will initiate the position and it will be visible in the position tab.

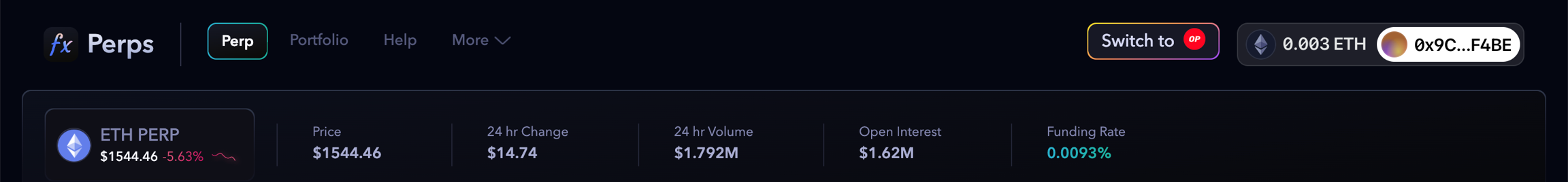

There is also a "funding rate" that is deducted over time as fees.

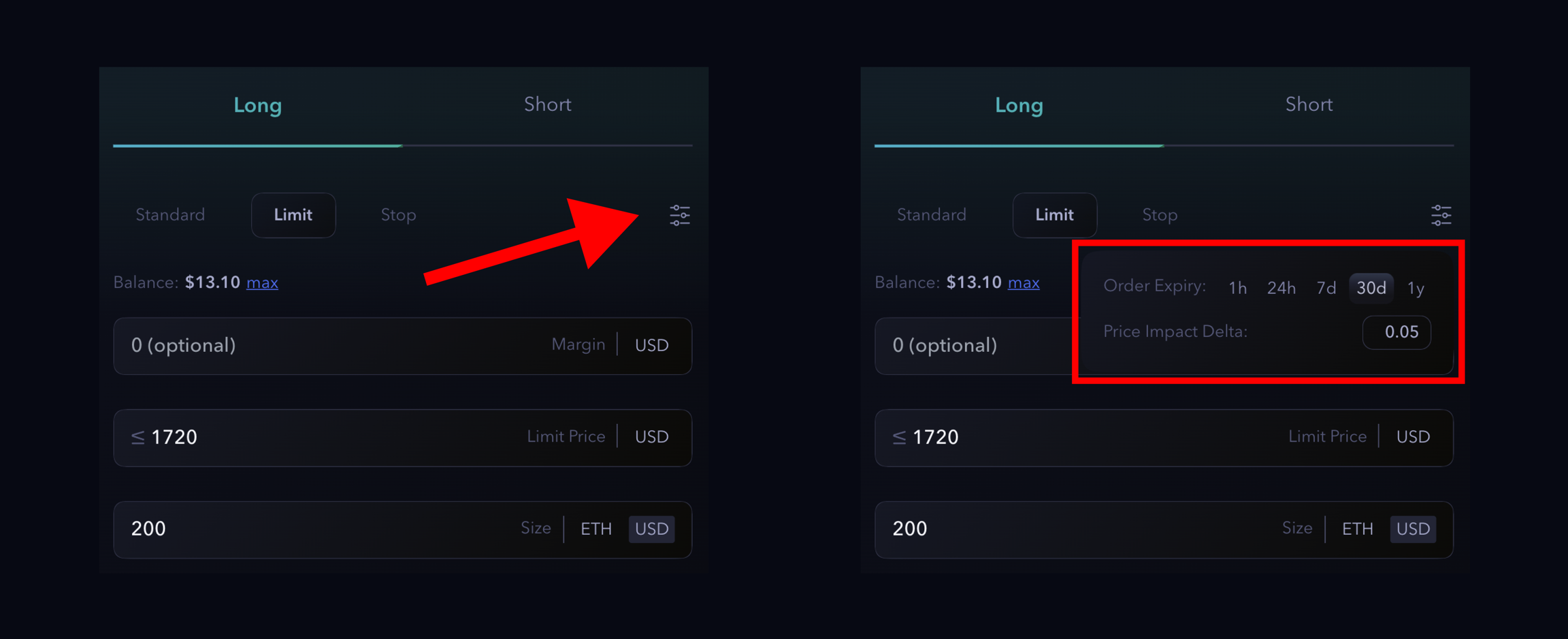

Expiry and Price impact

Traders can set the expiry and price impact delta of a new position manually in the UI. It helps the traders to manage their position when there is a huge movement in the market.

Click on the toggle next to the orders type and select the expiry of the Limit order and the Price impact delta for the order.

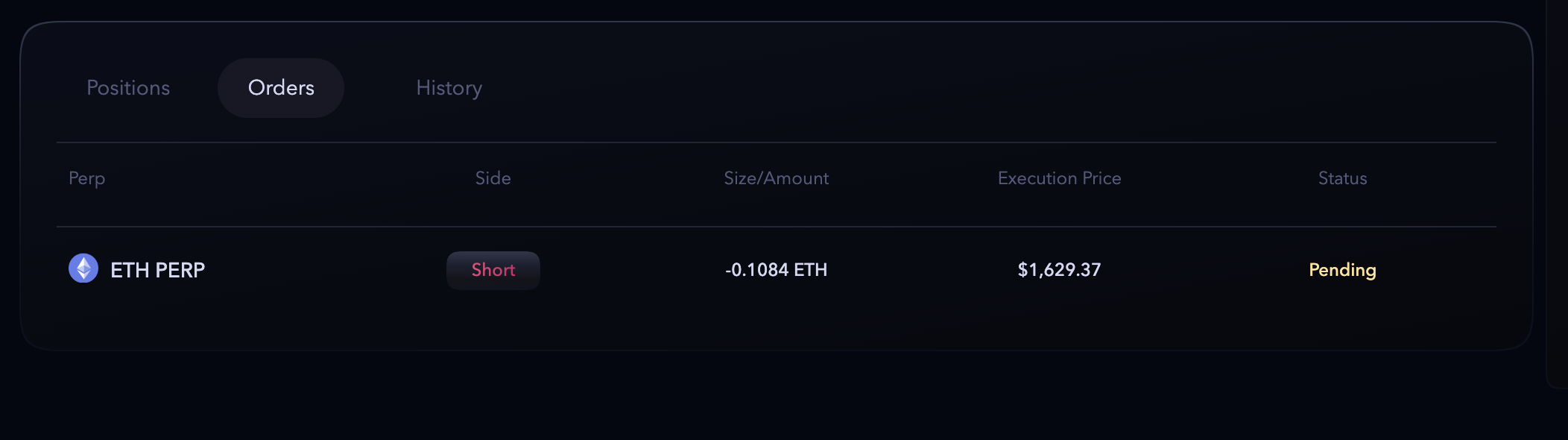

Managing positions

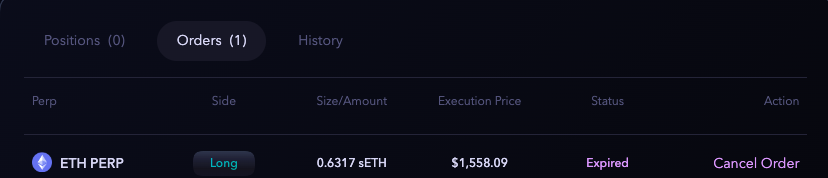

After opening the position, the trade comes on orders, and the trader can view the position status after the transaction is completed. All the unfilled orders will be kept in the orders tab until they get filled.

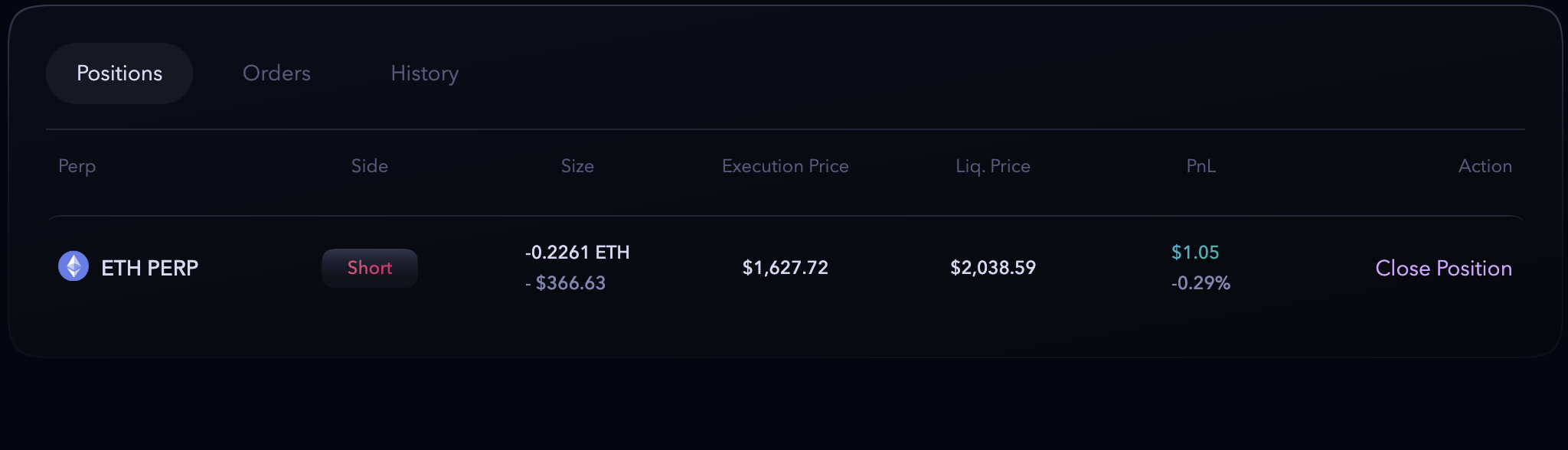

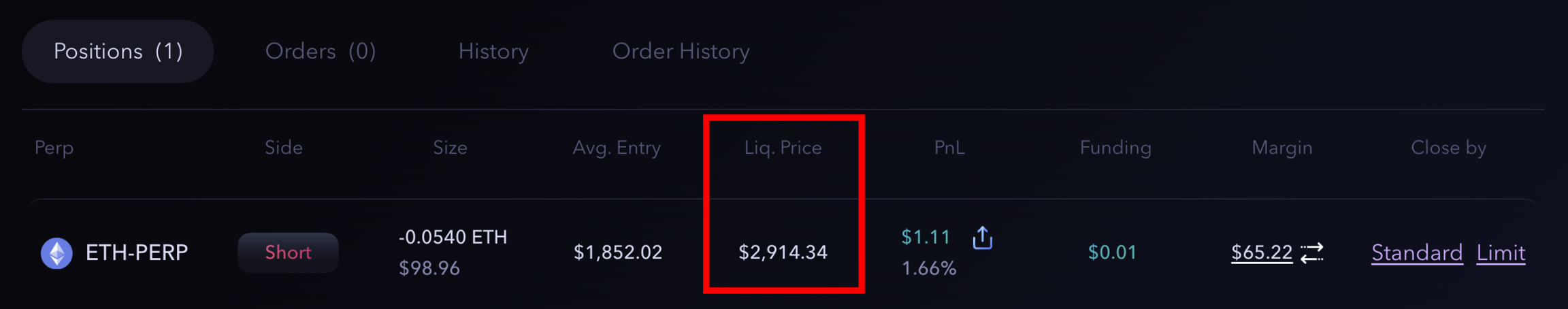

After opening the position, the trade comes on positions, and the trader can manage the trades on this tab. The trader can view the position size, open price, Liquidation price, and PnL on this tab.

If the trader opens another trade, then the exchange automatically averages both orders, recalculates the PnL and shows it in the position tab.

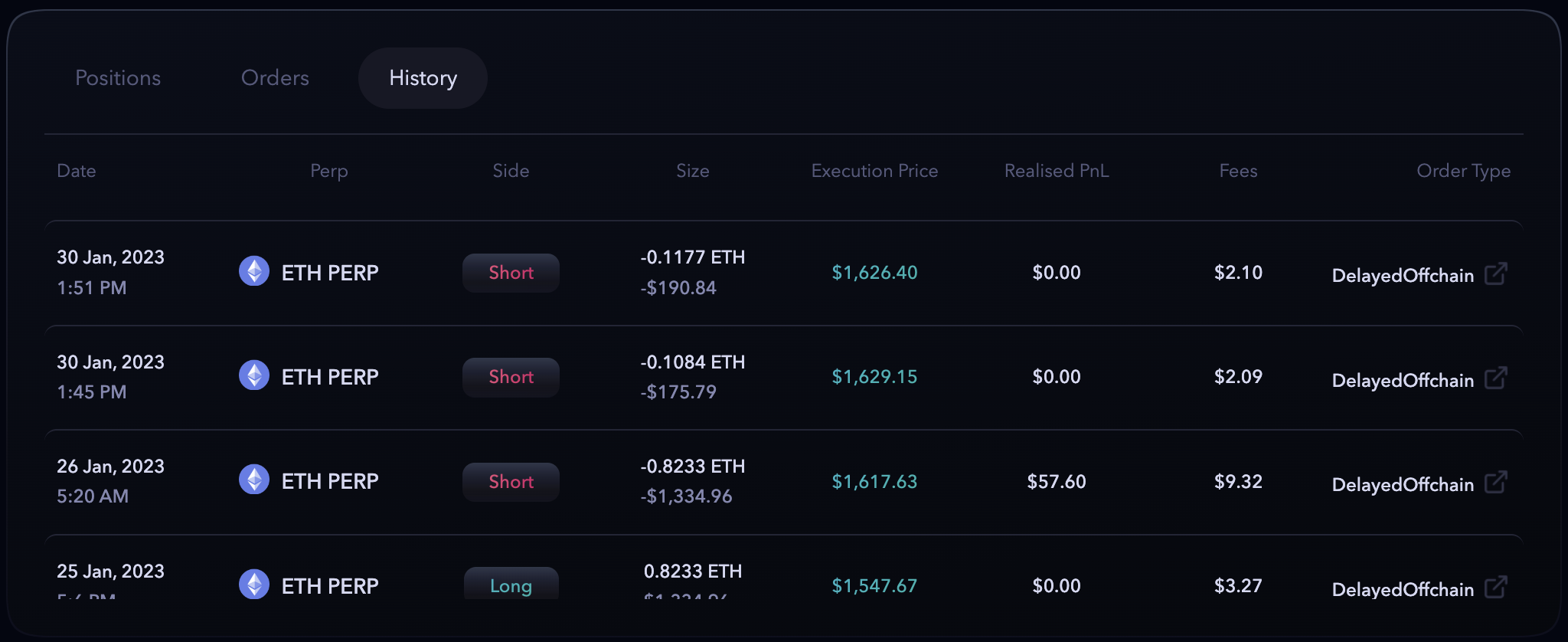

Also, the history tab will allow the traders to view all the trades on the exchange made by the user.

Expired Order

Expired order is a order that has not been filled because high volatility in the market or has reached its expiry time.

After an order expires you can decide to:

Do nothing or cancel the order.

Retrythe expired transaction, with a 1-click button to reproduce the transaction at market price.Create a new order, so the expired order gets cancelled in the same transaction.

Closing / Reduce a trade position

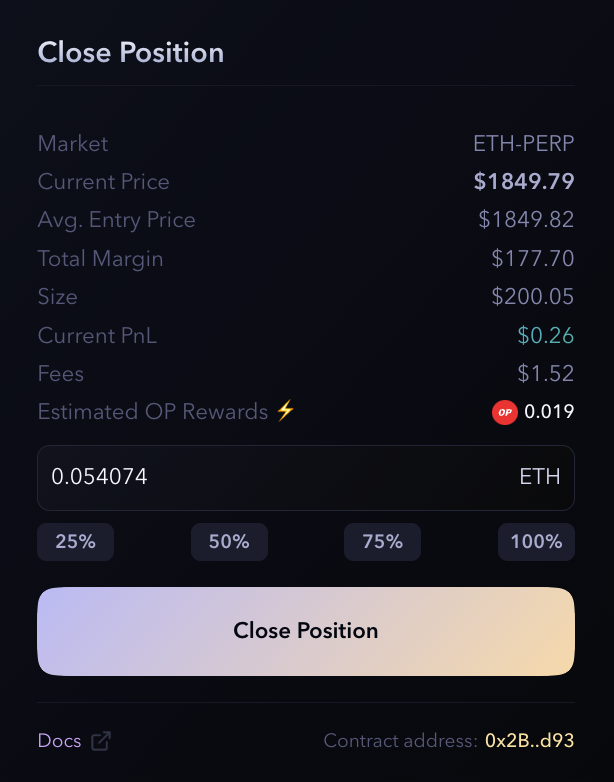

To close a trade position, the user can click Close or use the TP/SL feature directly in the Position tab clicking Add.

Check how to add TP/SL to a position here: Add TP/SL to a position.

When the user click Close a popup will appear and user can decide how much of that position close. Once transaction is made, the order will be closed or reduced and PnL will be realised according to the trade outcome.

The profit/loss will be credited to the wallet address after collecting all fees by exchange, and no fees will be deducted from the portfolio after the final transaction.

Users can also close or reduce a position, opening a trade in the opposite direction using any type of order.

Liquidations

When the trader does not have enough funds to meet the margin requirement, which is the amount of collateral that the trader must keep on deposit in order to maintain their open positions. In this case, the exchange will automatically liquidate the trader's positions to bring their account back within the required margin.

The liquidation price will be shown in the positions tab and if you are using more than 5x leverage, then always try to check the asset underlying price. The more leverage you take, the more chances are there for liquidation due to the volatility in the assets.

If there is any collateral remaining after deducting losses and fees, then the corresponding amount would be returned to your trading account.

Last updated