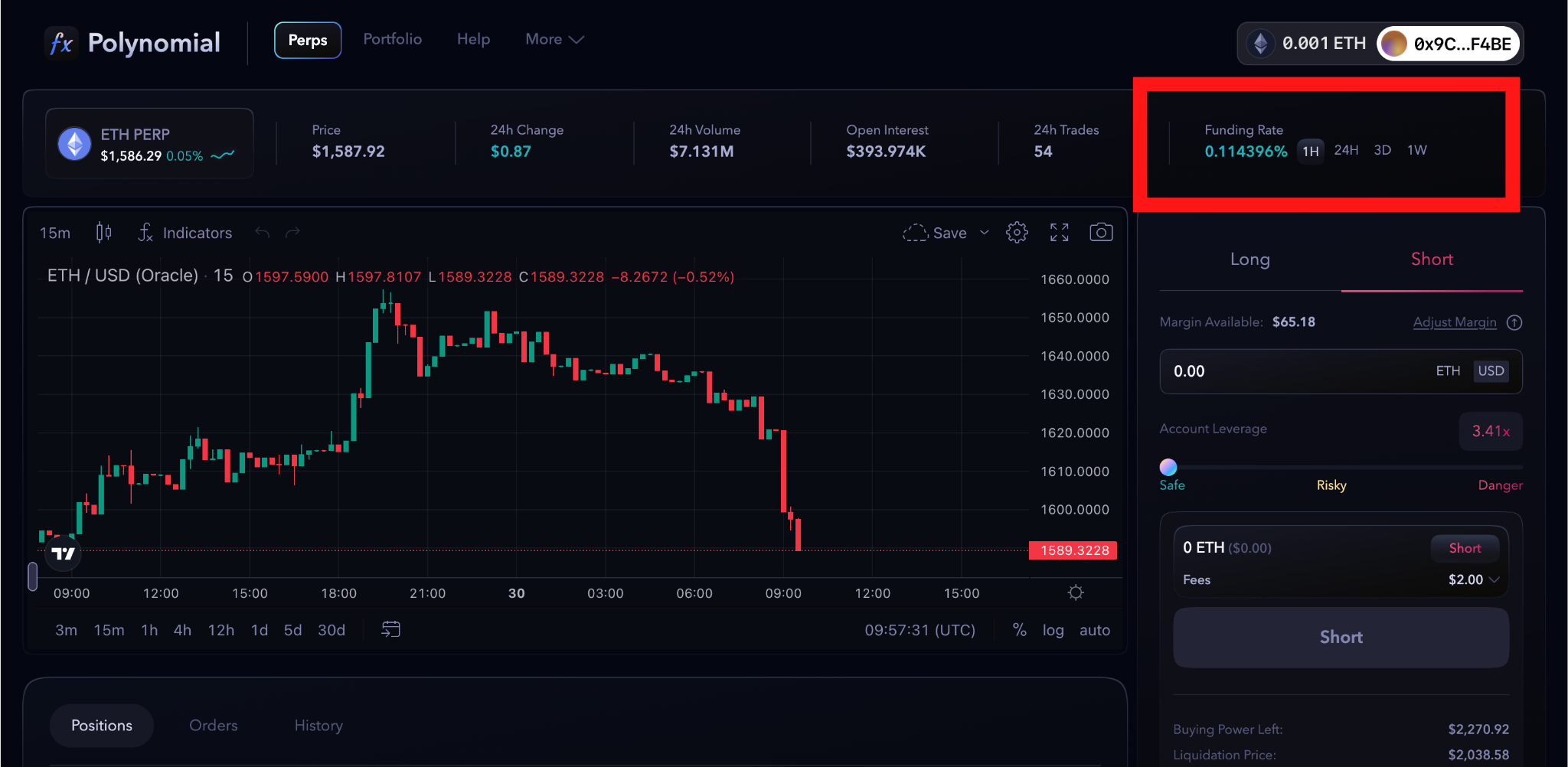

Funding rate

The funding rate in a perpetual futures contract is the fee that is paid by one side of the trade to the other in order to keep the contract price aligned with the underlying spot price. This fee is calculated and paid at regular intervals, typically every eight hours, based on the difference between the futures price and the spot price.

If the futures price is higher than the spot price, traders who are long the contract (i.e., expecting the price to rise) will be required to pay a funding fee to traders who are short the contract (i.e., expecting the price to fall). This fee is designed to bring the futures price down and align it with the spot price, so that traders on both sides of the trade have an equal chance of making a profit.

If the futures price is lower than the spot price, the opposite will be true and short traders will be required to pay a funding fee to long traders. This fee is designed to bring the futures price up and align it with the spot price, so that traders on both sides of the trade have an equal chance of making a profit.

The funding rate is an important aspect of perpetual futures contracts, as it helps to keep the contract price aligned with the underlying spot price and avoids the need for an expiration date. This allows traders to hold the position indefinitely and take advantage of price movements in the underlying asset without the pressure of a deadline.