Advanced Order v2

The integration of advanced orders on Polynomial is greatly enhancing the trading capabilities and strategies accessible to traders.

What's new & how it works?

With the integration of Pyth price for the execution process, transactions will be checked and executed more quickly. This approach allows users to obtain the best possible price and mitigate any risks associated with volatile markets.

After a conditional order is triggered, there is no guarantee of its successful execution. Factors such as liquidity constraints or network congestion can significantly affect the order's completion. With the Pyth prices the rate of successful execution increased.

Here are a few situations, including but not limited to:

The execution price did not reach the specified price.

The trigger price was reached but remained at that level for an insufficient duration to trigger execution.

No keeper accepted the order for execution.

Limit/Stop orders

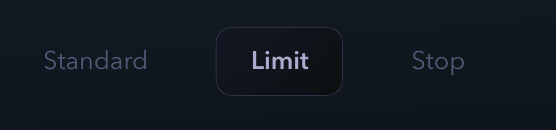

Traders can choose two types of Advanced orders when opening a trade:

Limit

Stop

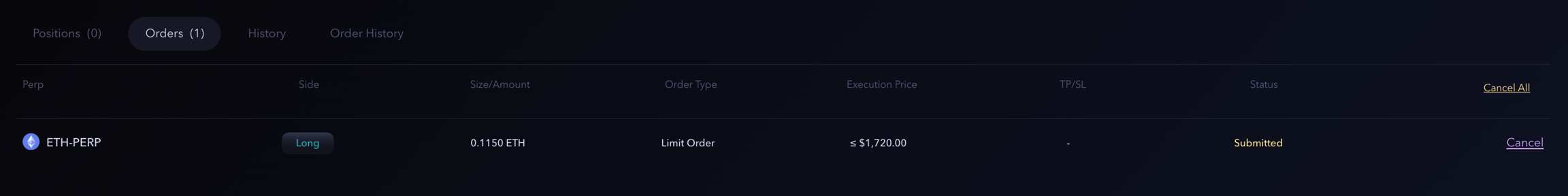

There are different steps that take place behind the scenes when a user wants to create a limit/stop order:

The user decides on all the parameters for the order.

Once the limit/stop order is created, the limit/stop price (trigger price) is compared with the on real time with the price feed from Pyth (execution price);

When the execution price reaches the trigger price, the limit/stop order is converted into a delayed order and executed by the keepers.

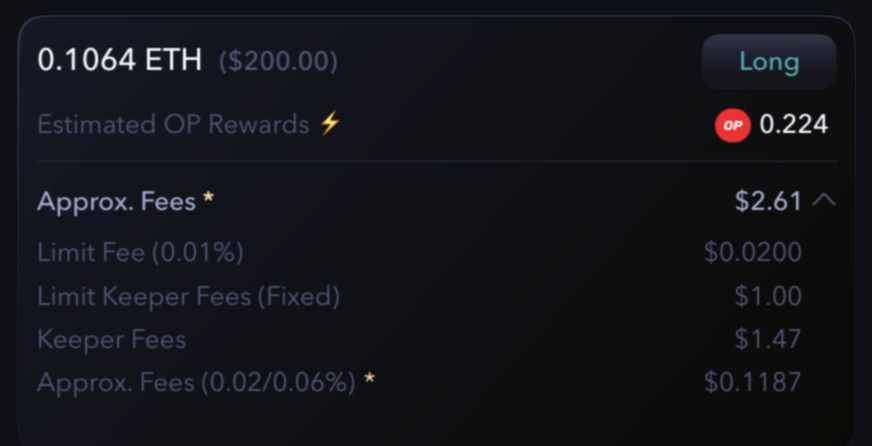

The execution of these orders requires Limit Fees, which have decreased by approximately 60% after the Badrock Update. For more detailed information, please refer to the following page: Fees for limit/stop orders

Note: that fees associated with the Take Profit and Stop Loss orders will be deducted upon execution, when the specified price levels are triggered.

Please note: that fees associated with the Take Profit and Stop Loss orders will be deducted upon execution, when the specified price levels are triggered.

Take Profit / Stop Loss Orders

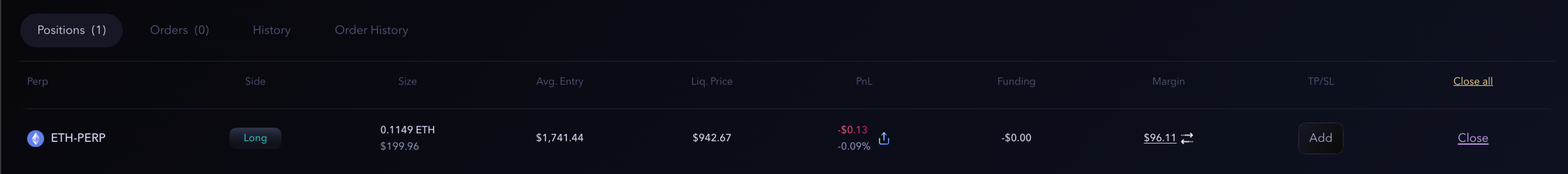

There is the option to add a TP and/or SL order when creating a new position or later.

Users can choose to add either one or both of these orders based on their preference and trading strategy.

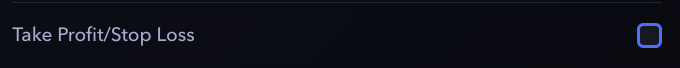

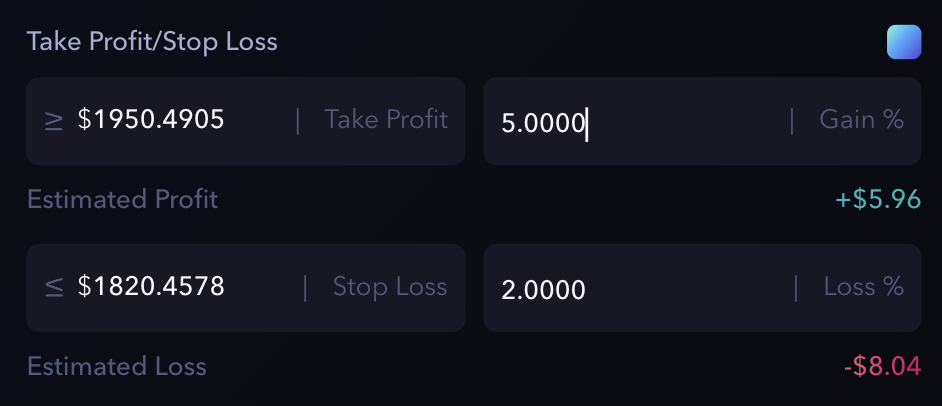

To create a TP/SL with a new position, users need to enable the toggle.

Gain and Loss take into account the regular fees for the trades as well as the fees associated with creating the TP/SL orders.

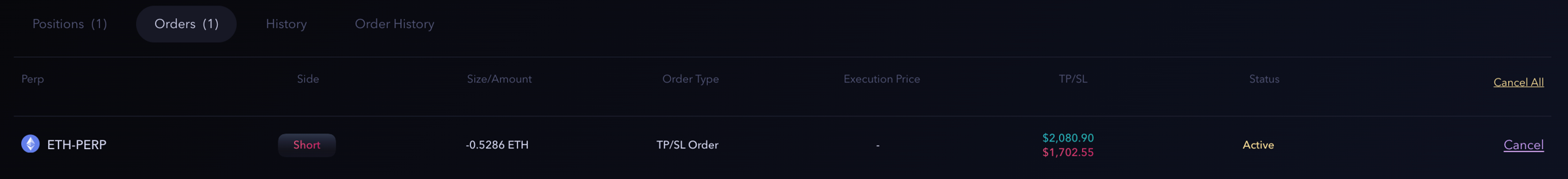

Once the TP/SL order is created, it will be visible just in the Orders tab.

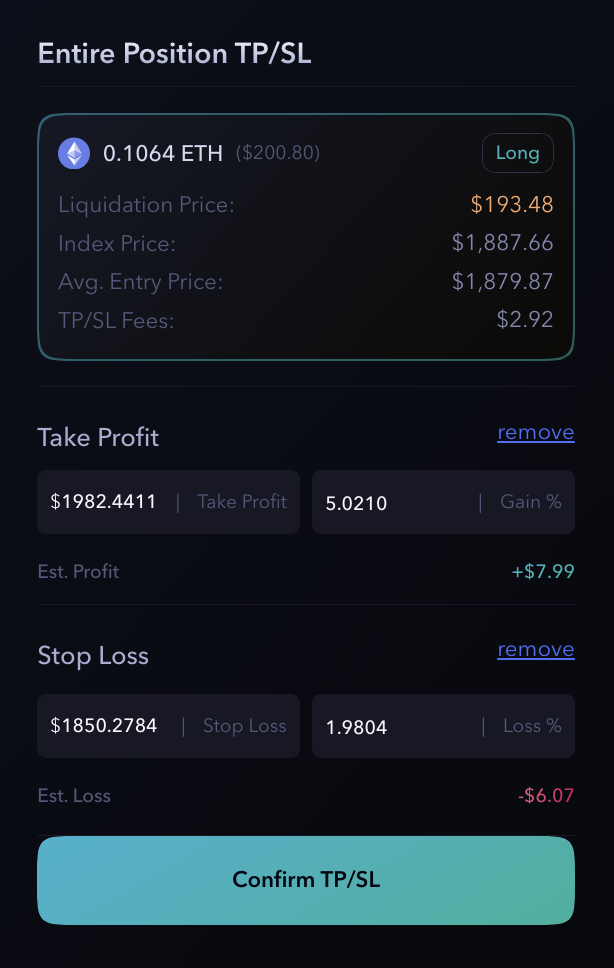

For an already open position, it is possible to add the TP/SL order by clicking the Add button in the Position tab:

TP/SL will be visible both in the Position tab alongside the corresponding position and in the Orders tab.

The main difference between creating a TP/SL order while opening a trade and adding it later is related to their association with the position.

When TP/SL is established during the initial trade entry, it is linked to a specific trade size. In other words, the TP/SL is set based on the parameters defined at the time of opening the position.

On the other hand, when TP/SL is added later, it is specifically assigned to an existing position. This means that the TP/SL order is tailored to the characteristics and requirements of that particular position.

In the case of a high price divergence (more than 2%) between Pyth and Chainlink, the execution price will be based on the Chainlink price.

It is important to note that while these orders can be effective risk management tools, they are not foolproof. In certain market conditions, such as during high volatility or low liquidity, the execution of these orders may differ from the intended price level. This is known as slippage and can result in trade executions at slightly different prices.

Traders should consider potential slippage and set their take profit and stop-loss levels accordingly to account for these factors.

Important: A reasonable buffer between the stop-loss level and the liquidation price, traders can enhance their chances of preventing liquidation events.

Closing a Position

To close a trade position with a TP/SL order, the process is the same as well as you want to add it later.

Users can simply click the Add button in the Position tab to set the trigger prices for the closure.

Check how to add TP/SL to a position here: Add TP/SL to a position.

The profit/loss will be credited to the wallet address after collecting all fees by exchange, and no fees will be deducted from the portfolio after the final transaction.

Users can also decide to close or reduce a position, opening a trade in the opposite direction using any type of order.

Trading Guide

For a step-by-step guide: