Take Profit / Stop Loss

Take Profit & Stop Loss

Take profit and stop loss orders enable traders to set target profit levels and maximum acceptable loss levels. Take profit and stop-loss orders provide a level of automation and help traders stick to their predefined trading plans.

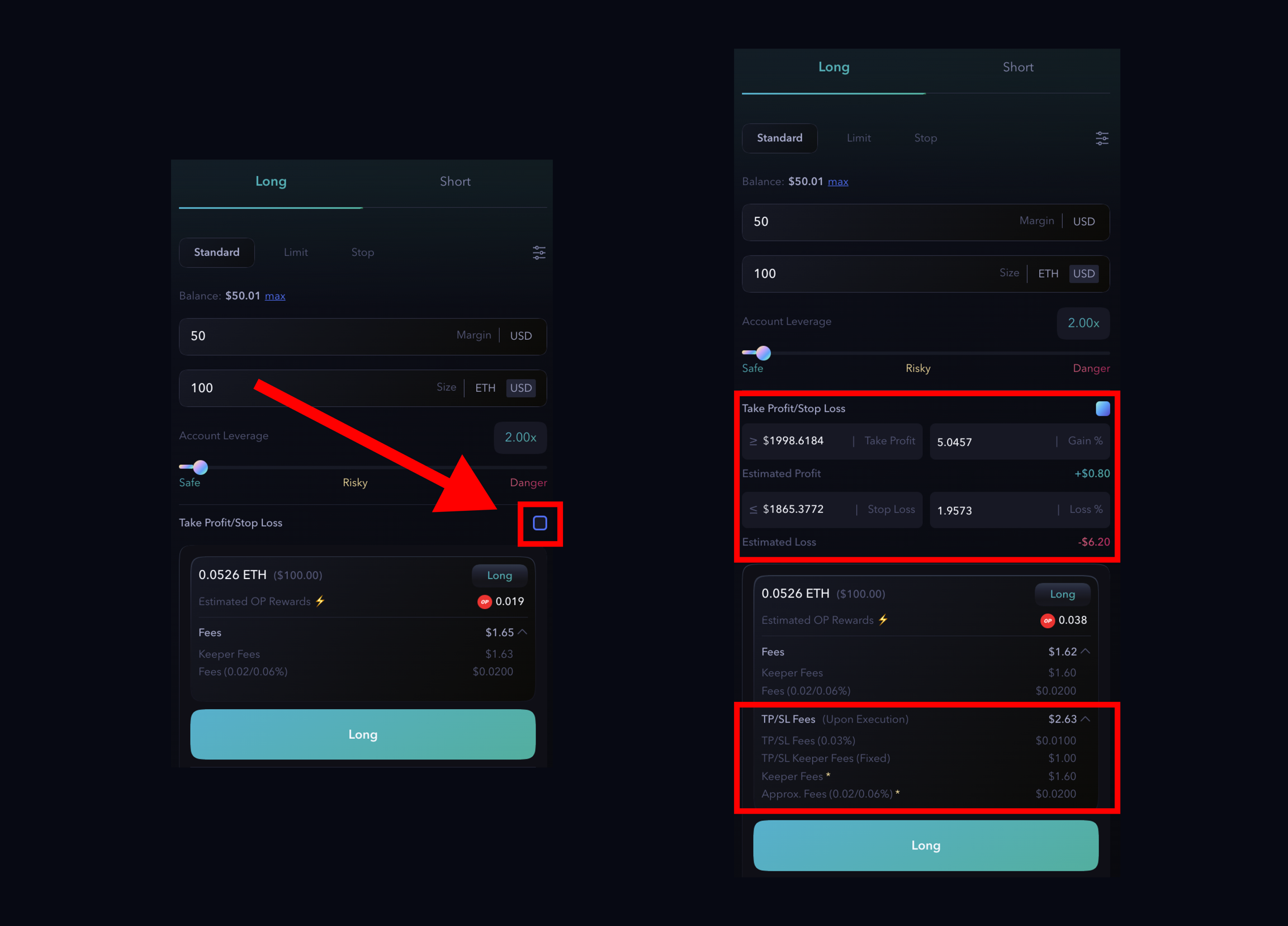

Opening a position with TP/SL

To allow traders to define both their target profit level and the maximum acceptable loss level, both orders can be placed simultaneously when entering a trade.

Decide the type of order you want to create between

Standard,LimitorStop;Check the TP/SL box to abilitate it;

Enter the parameters to trigger TP and/or SL and click

LongorShortbutton;

Please note that fees associated with the Take Profit and Stop Loss orders will be deducted upon execution, when the specified price levels are triggered.

Gain and Loss take into account the regular fees for the trades as well as the fees associated with creating the TP/SL orders.

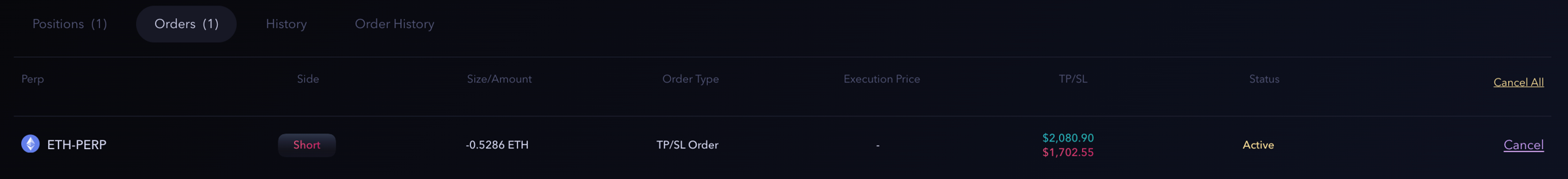

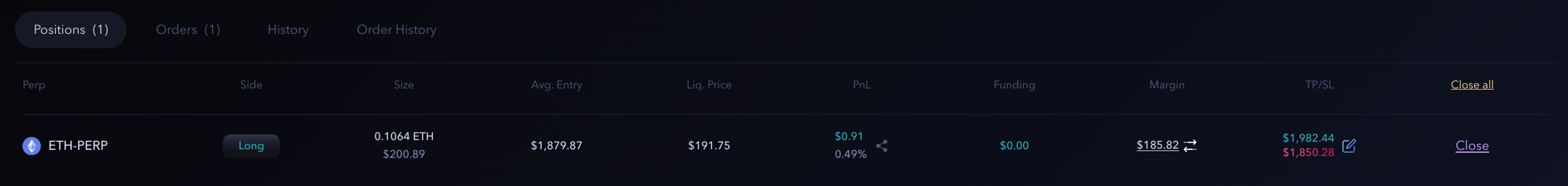

The TP/SL (and limit/stop type order) will be shown in the Orders tab, meanwhile the (standard) order executed by the keepers will be shown in the Positions tab;

When user opens a trade with TP/SL two different orders will be generated.

The new trade position

The TP/SL

Both the orders generated have same size

Note: When you create TP/SL with a new position, it is not shown in the Position tab, but in the Order tab. This because the TP/SL correspond to a specific size and not to that particular position.

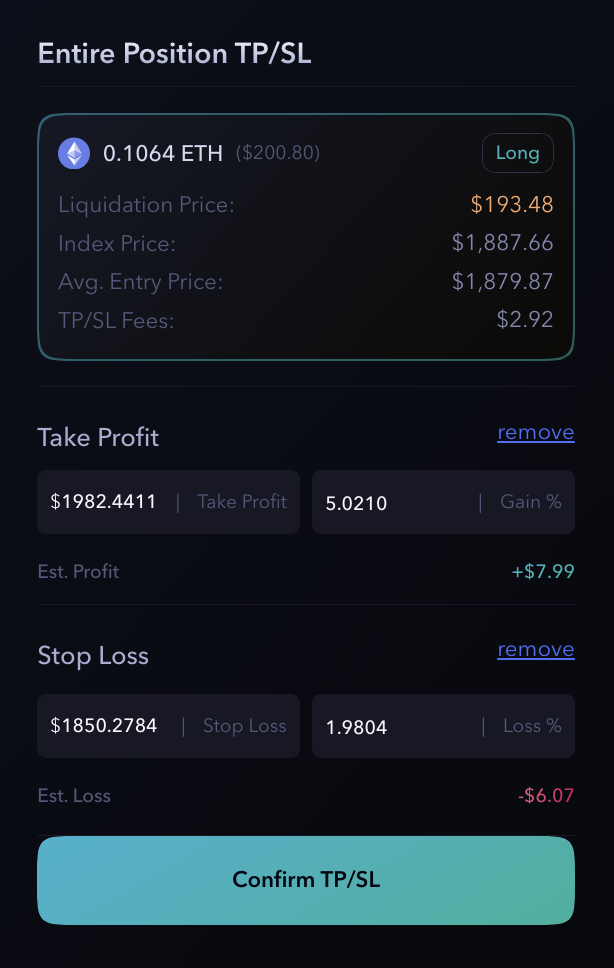

Add TP/SL to a position

It is possible to add a TP/SL to an entire existing position:

Click the

Addbutton;

A popup will appear and you can decide the trigger price for TP and/or SL for the entire position; and click

Confirm TP/SL

Remember: fees associated with the Take Profit and Stop Loss orders will be deducted upon execution, when the specified price levels are triggered.

Gain and Loss take into account the regular fees for the trades as well as the fees associated with creating the TP/SL orders.

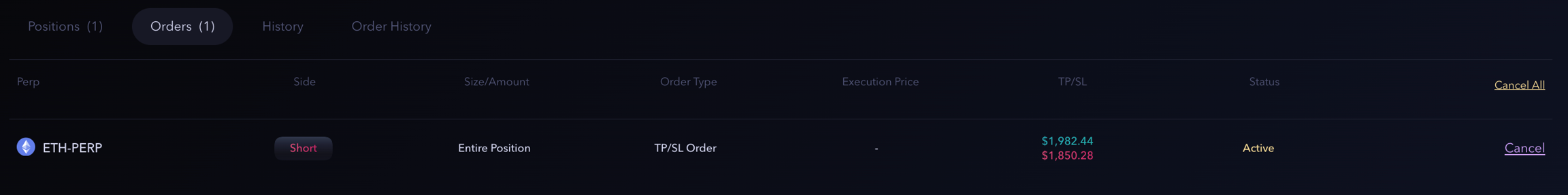

Once validate the transaction the TP/SL will be shown on Order tab and Position tab

TP/SL is available in the position tab because it is related the whole position

The main difference between creating a TP/SL order while opening a trade and adding it later is related to their association with the position.

When TP/SL is established during the initial trade entry, it is linked to a specific trade size. In other words, the TP/SL is set based on the parameters defined at the time of opening the position.

On the other hand, when TP/SL is added later, it is specifically assigned to an existing position. This means that the TP/SL order is tailored to the characteristics and requirements of that particular position.

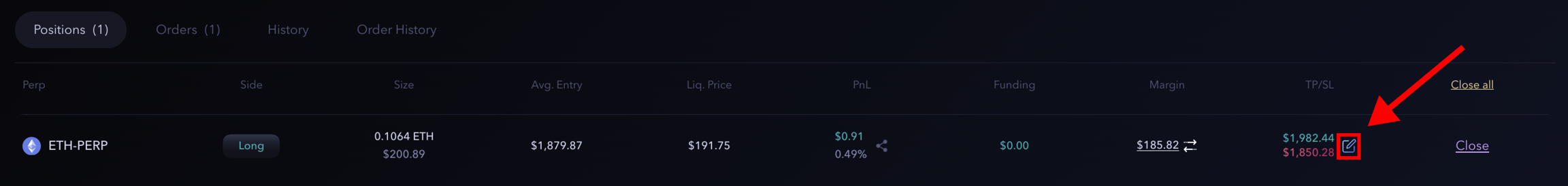

Modify a TP/SL

It is possible to modify a TP/SL to an existing position clicking the "Edit" button in the Position tab.

After clicking, the popup similar Add TP/SL to a position will appear. A transaction will exectute this new TP/SL and cancel the previous one.

Cancel a TP/SL

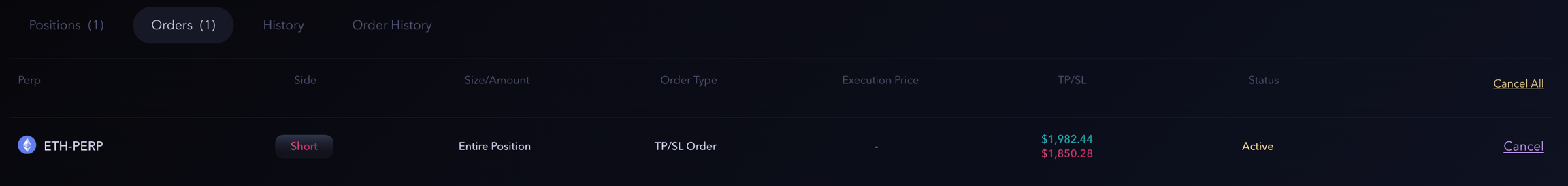

To cancel a TP/SL is enough to go on Orders tab and click Cancel

It is important to note that while these orders can be effective risk management tools, they are not foolproof. In certain market conditions, such as during high volatility or low liquidity, the execution of these orders may differ from the intended price level. This is known as slippage and can result in trade executions at slightly different prices.

Traders should consider potential slippage and set their take profit and stop-loss levels accordingly to account for these factors.

Important: A reasonable buffer between the stop-loss level and the liquidation price, traders can enhance their chances of preventing liquidation events.