Funding Rate Arbitrage 101

Let's discuss the funding rate arbitrage strategy. Funding rate arbitrage is a trading strategy that takes advantage of the differences in funding rates between different markets. The key point of this strategy is to maintain a delta-neutral position, which means balancing the overall directional exposure of the trader's positions.

Here is a more detailed explanation.

How does it work?

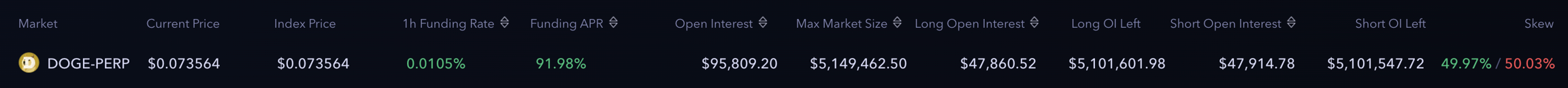

Identifying markets with high funding rates: Identify markets with high funding rates: The first step is to find markets with significantly positive or negative funding rates. These are markets where the cost of holding a position is either paid by long positions or short positions. An easy view of all polynomial's markets can be found here: https://trade.polynomial.fi/markets. Example 1: Suppose we find a good opportunity in the DOGE market with a funding rate of approximately +0.01% per hour. Since positive funding means that short positions are paid by long positions, we will take a short position in this case.

Finding another platform for opposite position: To take advantage of the funding rate discrepancy and achieve delta neutrality, you need to find a platform where you can open a position in the opposite direction with a favourable funding rate. Example 2: On Binance, we discover that the DOGE perpetual future has a funding rate of -0.016% over 8 hours. To make a fair comparison, we convert it to an hourly rate by dividing it by 8, resulting in a funding rate of -0.002% per hour.

Opening (long-short) positions: Once you have identified the markets and platforms, you open both long and short positions at the same time. This allows you to be delta neutral and limits your exposure to volatile assets while earning the funding rate. Example 3a: we can open a short position on DOGE on Polynomial with a funding rate of +0.01% per hour. At the same time, we can open a long position on DOGE on Binance with a funding rate of -0.002% per hour. Example 3b: since we are shorting the asset in the futures market on Polynomial by selling a DOGE contract, we can simultaneously buy the same asset in the spot market instead.

Farming the funding rate: By holding these positions open during the funding period, you earn the funding rate as profit. The longer you hold the positions, the more funding rate you accumulate. Example 4a: If you hold the positions for one day during the funding period, you would earn a net gain of 0.24% on Polynomial (0.01% multiplied by 24 hours) and a net gain of 0.048% on Binance. Example 4b: If the funding period lasts for one day, holding the positions for that duration would result in a net gain of 0.24% on Polynomial. Additionally, you can use the spot position on Polynomial to earn additional rewards, such as lending or staking ETH.

Considering open interest: Open interest, which represents the total number of open contracts in a market, affects the funding rate calculation. Higher open interest generally leads to more significant funding rates. Traders monitor changes in open interest to understand the dynamics and potential shifts in funding rates across markets.

NOTE: this procedure is for informational purposes only, and before making any decisions, it is advisable to fully understand the dynamics behind it (DYOR). If you have any other strategies in mind, please feel free to share and discuss them on Discord.